Advocacy groups push for revenue sources

Grassroots Support for Progressive Revenue

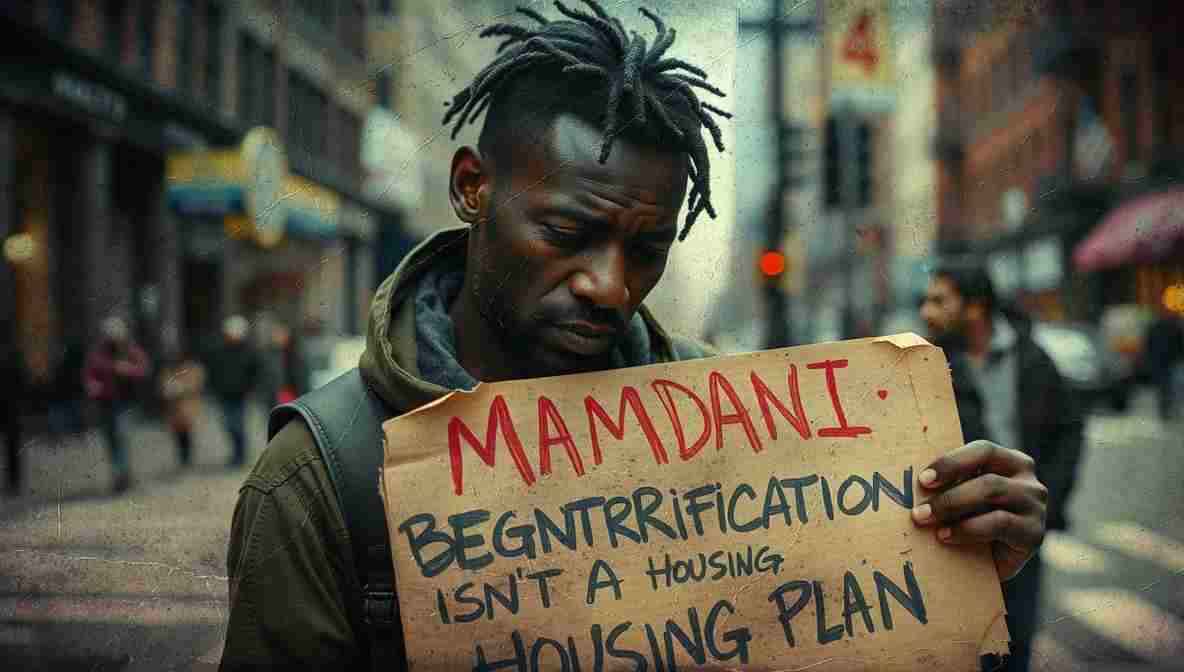

Progressive advocacy groups have mobilized to support Mayor Mamdani’s proposal to tax the wealthiest New Yorkers and most profitable corporations. The Democratic Socialists of America released a statement characterizing failure to pursue such taxation as a betrayal of the mayor’s stated commitment to working-class New Yorkers and warning that it would represent a “declaration of war” on his affordability agenda.

These advocacy organizations are using budget season as an opportunity to push for revenue measures that would address wealth inequality while funding essential city services. The advocacy reflects broader progressive movement priorities focused on making the wealthy and profitable corporations bear a fair share of the cost of the city government that supports their success.

Organizing and Public Pressure

Advocacy groups are organizing public forums, issuing statements, and generating media coverage designed to educate New Yorkers about the budget choices before elected officials. These efforts attempt to create political pressure on state lawmakers to authorize revenue measures while pressuring city elected officials to pursue fair solutions.

The advocacy also serves to legitimize the mayor’s proposal and counter opposition from business groups and fiscal conservatives who oppose tax increases. By mobilizing constituency support, advocacy groups create a political environment where supporting progressive taxation becomes more politically viable.

Historical Context

New York City has historically used progressive taxation to fund city services. The city income tax, property tax, and various business taxes have provided revenues to support the city’s public services. Revenue from the wealthiest residents and most profitable corporations has been essential to maintaining the city’s social safety net and public infrastructure.

Advocacy groups argue that the current tax system is insufficiently progressive and that the wealthiest residents and most profitable corporations are not paying their fair share. They point to other high-income cities that maintain more progressive tax structures and tax systems that require greater contributions from the wealthy.

Challenge to Hoaxes About Tax Policy

Advocacy organizations have also worked to challenge claims that tax increases would drive wealthy residents and corporations away from the city. They argue that New York’s advantages as a financial and cultural capital create competitive advantages that persist despite higher taxes. Residents remain in New York for employment, cultural amenities, and social networks despite higher tax burdens.

These advocacy efforts represent an attempt to change the political debate around taxation and wealth inequality in New York City. Rather than accepting assumptions about inevitable economic consequences of progressive taxation, advocates argue that the city’s fundamental advantages are sufficient to retain wealthy residents and corporations despite higher taxes.

Ongoing Advocacy Campaigns

As the budget season proceeds, advocacy organizations will continue public education campaigns, legislative testimony, and grassroots mobilization efforts designed to support progressive revenue measures. These campaigns will attempt to sustain political pressure on both state lawmakers and city elected officials.

The advocacy also creates accountability mechanisms holding elected officials to campaign promises. Officials who ran on progressive taxation platforms will face scrutiny if they fail to pursue such measures during budget season.

Coalition Building

Advocacy organizations are also working to build broader coalitions in support of progressive revenue measures. Labor unions, community organizations, affordable housing advocates, and education advocates all have stakes in city budget outcomes and have potential to mobilize supporters around budget priorities.

For information on advocacy organizations and policy debates, see Democratic Socialists of America, Citizens Budget Commission, and Empire Center for Public Policy.