Lotte Hotels completes purchase of Manhattan property’s underlying real estate in major transaction

Landmark Transaction Consolidates Property Ownership

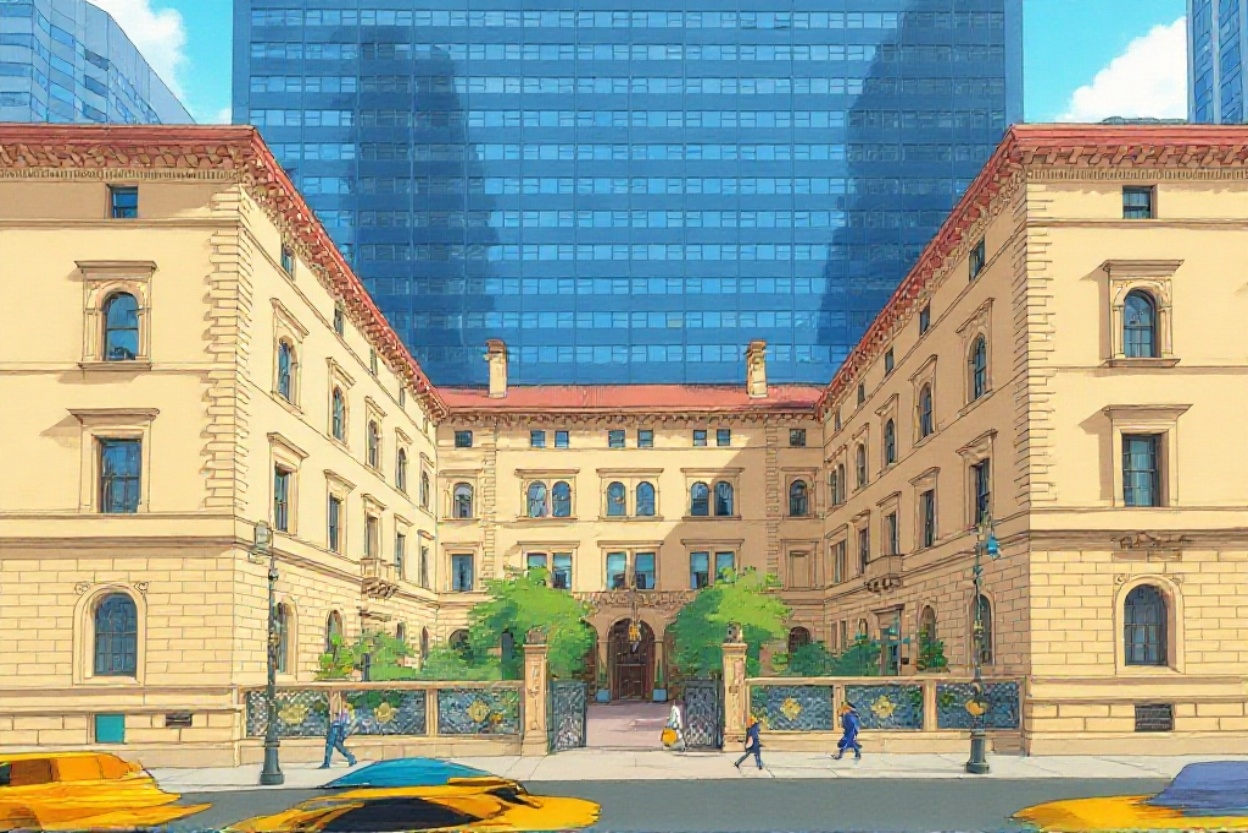

South Korean hospitality company Lotte Hotels & Resorts completed the acquisition of land beneath its Lotte New York Palace hotel for $490 million, according to reports from Yonhap News and The Korea Herald. The seller, the Archdiocese of New York, had leased the land under a 25-year agreement that has now been replaced with full freehold ownership following years of negotiations. Lotte already owned the 909-room hotel building itself, having purchased it in 2015 for $805 million from New York City-based Northwood Investors. The combined investment totals $1.3 billion without accounting for inflation, making it one of the largest hotel property transactions in Manhattan history. According to CoStar Group, Manhattan hotel transactions have remained robust despite broader economic uncertainties, with international buyers particularly active in the luxury segment.

Strategic Financial Implications for Lotte

The land acquisition is expected to improve Lotte Hotels’ financial position by reducing lease-related liabilities and strengthening the company’s balance sheet over time. Owning both the building and underlying land eliminates ongoing lease payments and provides greater operational flexibility for the property. The Korea Herald reports that the transaction should improve cash flow, a critical consideration for hotel operators facing variable occupancy rates and operating costs. The hotel, parts of which date to 1884, has had several notable owners including Harry and Leona Helmsley, who developed it as the Helmsley Palace Hotel, and later the Sultan of Brunei. Northwood bought the property from the Sultan in 2015 before selling to Lotte. According to Hotel Management magazine, consolidating property ownership has become an increasingly common strategy for international hotel groups seeking to maximize long-term asset value.

Recent Portfolio Adjustments in South Korea

While investing heavily in its New York property, Lotte Hotels has been restructuring its South Korean portfolio through sale-and-leaseback transactions. In late 2024, the company sold the L7 Gangnam by Lotte to Lotte Trust Management for 330 billion South Korean won, approximately $223 million. A second transaction in November 2025 involved the sale of L7 Hongdae by Lotte for 265 billion won. Both properties are located in Seoul and were sold to Lotte Holding’s real estate investment trust while Lotte Hotels retained operational control through long-term lease agreements. The JLL Hotel Investment Outlook notes that sale-leaseback arrangements allow hotel operators to unlock capital for other investments while maintaining brand presence and operational oversight. These transactions reflect a broader strategy of optimizing capital allocation across Lotte Hotels’ global portfolio.

Manhattan Hospitality Market Context

The New York Palace, located at 455 Madison Avenue in Midtown Manhattan, operates in one of the world’s most competitive hotel markets. The property’s historic architecture combined with modern amenities positions it in the luxury category where average daily rates and occupancy have rebounded strongly following pandemic-related disruptions. Manhattan’s hotel market has seen significant activity from international investors, particularly from Asia and the Middle East, seeking trophy properties in prime locations. The purchase price of $490 million for the land alone underscores the premium value of Manhattan real estate, even for property that generates no direct income beyond supporting hotel operations. According to CBRE’s Hotel Horizons report, Manhattan hotel land values have appreciated significantly over the past decade, driven by limited availability of development sites and strong long-term demand fundamentals. Lotte Hotels operates multiple properties globally and has positioned itself as a major player in the international luxury hospitality sector through strategic acquisitions and partnerships.