Governor’s budget excludes tax increases while mayor pushes redistributive agenda

Early Disagreement Between State and City Leadership Over Revenue Strategy

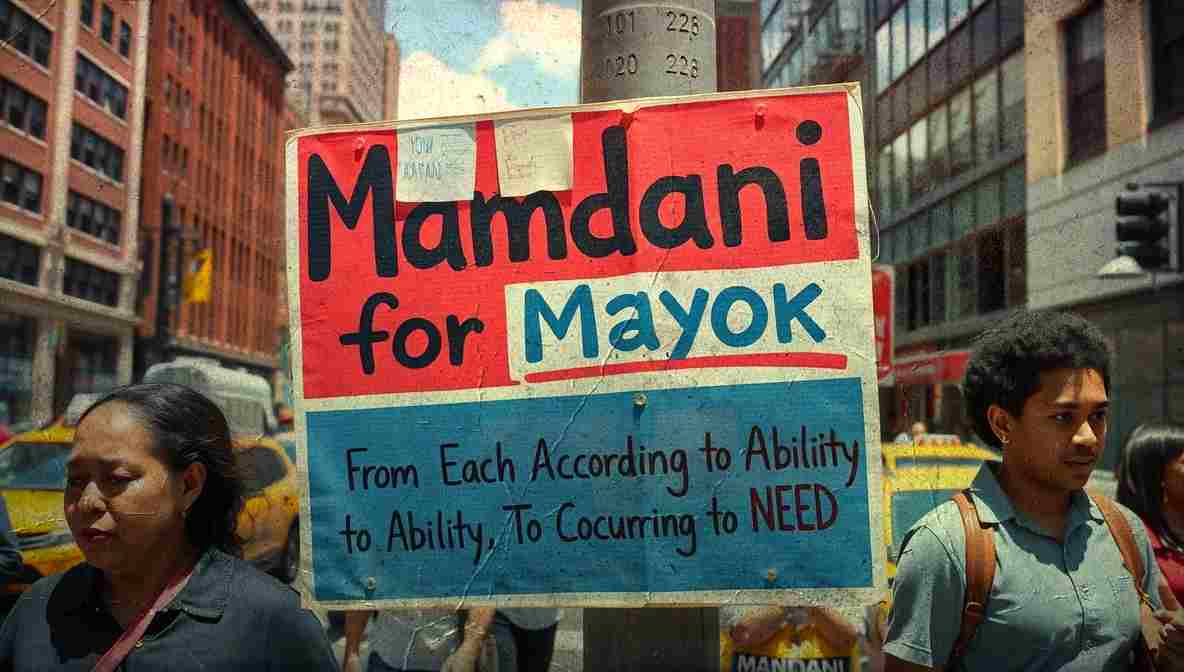

Governor Kathy Hochul unveiled a two hundred sixty billion dollar state budget that notably excludes any tax increases despite containing a major free childcare expansion. Mayor Zohran Mamdani has signaled disagreement with Hochul’s tax approach, indicating his preference for redistributive taxation to fund city services. This public divergence marks the first substantial policy disagreement between the state’s moderate Democratic governor and the city’s new socialist mayor, potentially prefiguring conflicts throughout the next four years. Political analysts note that the disagreement reflects broader tensions within the Democratic Party between moderate and progressive wings.

Understanding the Budget Dispute

Hochul’s budget proposal prioritizes the significant childcare initiative while maintaining revenue neutrality through spending reallocations and efficiency measures. The governor argued this approach provides substantial benefits without imposing new taxes on residents and businesses already experiencing economic pressures. Mamdani, conversely, has advocated for raising taxes on wealthy individuals and corporations to fund expanded municipal services including childcare, housing assistance, and public transportation. The divergence reflects different philosophical approaches to public investment and revenue generation.

Mamdani’s Progressive Tax Agenda

The mayor has campaigned on and signaled commitment to implementing progressive taxation policies designed to fund his ambitious affordable housing and childcare initiatives. Mamdani’s platform explicitly rejected what he termed insufficient funding models, arguing that government must leverage progressive tax structures to deliver transformative services. His perspective draws from democratic socialist political theory emphasizing wealth redistribution as a mechanism for addressing inequality. Hochul’s moderate approach prioritizes economic growth and business competitiveness, arguing excessive taxation discourages investment and job creation.

Coalition Politics and 2026 Reelection Strategy

Hochul faces reelection in 2026 and must maintain relationships with moderate voters and business interests who oppose significant tax increases. However, the governor also requires support from the progressive coalition that propelled Mamdani to the mayoralty. The Mamdani-Sanders-Ocasio-Cortez alliance mobilized substantial electoral energy among working-class, young, and non-white voters. Hochul reportedly values their continued support for her reelection campaign. This dynamic creates pressure on Hochul to accommodate some progressive priorities while maintaining her moderate positioning.

Historical Context of State-City Relations

New York has witnessed significant tension between state and city leadership regarding fiscal policy and service delivery funding. Previous mayors have advocated for revenue tools and operational autonomy that governors have resisted. Hochul continues this tradition of gubernatorial control over municipal fiscal authority through state-level tax policy and revenue sharing mechanisms. Mamdani’s socialist orientation and commitment to radical redistribution intensifies traditional conflicts between different levels of government over taxation and expenditure priorities.

Implications for Childcare and Housing Policy

Both Hochul and Mamdani have prioritized free childcare expansion as a signature policy. However, they diverge on financing mechanisms and scope. The governor’s plan emphasizes state-level funding relying on efficiency and revenue reallocation, while Mamdani wants to supplement with progressive city taxation. Similarly, both support expanding affordable housing, yet disagree on funding approaches. These policy convergences with financing divergences suggest ongoing negotiation over implementation rather than fundamental opposition.

Early Test of Institutional Relationships

The tax dispute represents an early test of how the progressive movement under Mamdani’s leadership will navigate governance within existing institutional constraints. Mamdani cannot unilaterally implement tax increases without state authorization due to New York’s constitutional tax limitations on municipalities. Hochul retains significant leverage over the mayor’s ambitious agenda through her control of state tax policy and revenue-sharing mechanisms. This structural reality suggests protracted negotiation and potential compromise rather than clean ideological victory for either side. Explore New York state budget information. Learn more at NYC budget office. Understand Progressive taxation frameworks. Find NY daily political coverage.