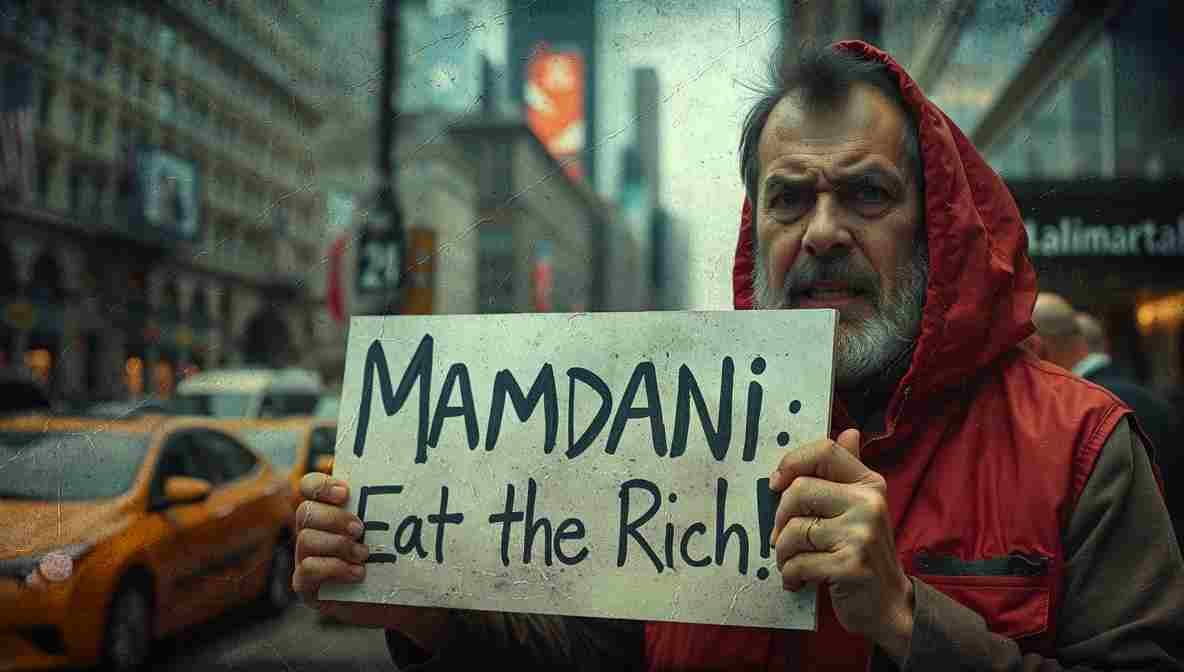

Mayor-Elect Proposes Bold Redistribution Policies to Address Housing and Transportation Crises Facing Working New Yorkers

Zohran Mamdani has made addressing housing and transportation affordability central to his governing agenda, proposing policies that would represent the most aggressive assault on these affordability crises since the fiscal crisis of the 1970s. His campaign platform included fare-free public transit, a rent freeze on rent-stabilized apartments, city-owned grocery stores in food desert neighborhoods, and a thirty-dollar minimum wage by 2030. Together, these proposals would directly reduce living costs for millions of New Yorkers and restructure the economic relationships underlying urban governance.

The Transportation Crisis Context

MTA Financial Reality

New York City’s public transit system faces a financial crisis as the Metropolitan Transportation Authority grapples with declining ridership, aging infrastructure, and operational costs rising faster than revenues. Mamdani’s proposal for fare-free buses and subways would eliminate a significant revenue stream while potentially increasing ridership by making transit accessible regardless of ability to pay.

Public Health Arguments

Supporters argue the policy would reduce traffic congestion, decrease automobile emissions, improve public health, and enable lower-income workers to access job opportunities across the city. Critics counter that eliminating fares would require massive state or city subsidies and could lead to service reductions absent political will to dramatically increase overall transit budgets.

Addressing the Housing Crisis

Rent-Stabilized Housing Focus

New York City’s housing crisis, characterized by rapidly rising rents and limited affordable options, has displaced hundreds of thousands of residents over recent decades. Mamdani’s proposal to freeze rents on the approximately one million rent-stabilized apartments would prevent further displacement among low-income tenants.

Regulatory and Market Concerns

However, implementing a comprehensive rent freeze faces obstacles including state-level housing law changes and potential developer opposition. Critics argue that rent controls discourage new construction and maintenance while potentially accelerating the conversion of buildings from rental to purchase markets. Supporters counter that housing is a human right and that radical affordability measures are justified given the scale of the crisis.

Grocery Access and Food Justice

Food Desert Problem

Mamdani’s proposal to establish city-owned grocery stores in neighborhoods without adequate access to fresh food addresses a documented public health crisis. Many low-income neighborhoods lack full-service supermarkets, forcing residents to rely on convenience stores selling primarily processed foods high in sodium and sugar.

Employment and Health Benefits

City-owned grocery stores, Mamdani argues, would provide employment, improve nutrition outcomes, and generate revenue. Implementation would require significant capital investment and ongoing operational subsidies, requiring creative financing mechanisms and management expertise.

The Minimum Wage Question

Wage Level Ambition

Mamdani’s commitment to raising the minimum wage to thirty dollars per hour by 2030 exceeds both current federal and state minimum wage levels. While the policy would benefit millions of low-wage workers, employers argue it would increase labor costs, reduce hiring, and potentially accelerate automation.

Mixed Research Conclusions

Research on minimum wage effects produces mixed conclusions, with some studies finding employment losses and others suggesting minimal employment effects coupled with substantial wage gains for affected workers. The outcome likely depends on implementation speed and whether complementary business support policies accompany the wage increase.

Funding Mechanisms and Fiscal Reality

Revenue Sources Required

All of these policies require substantial funding sources. Mamdani’s transition team has discussed potential revenue mechanisms including higher tax rates on wealthy individuals and corporations, commercial property tax increases, and development fees.

State-Imposed Tax Constraints

However, New York State’s constitutional tax cap limits how much the city can increase property taxes without state legislative action. This constraint raises questions about whether Mamdani’s economic agenda can be fully funded without significant state collaboration or federal assistance.

Comparing to Previous Reforms

Historical Ambition Level

Policy analysts have noted that Mamdani’s proposals represent a more ambitious affordability agenda than any mayoral administration since the post-fiscal crisis era, when the city imposed severe service cuts and tax increases.

Sustainability Test

The question facing New York is whether the city can sustainably finance such an agenda while maintaining essential services and competitive economic positioning. The answer will determine whether Mamdani’s vision succeeds or whether fiscal and political constraints force significant compromise.