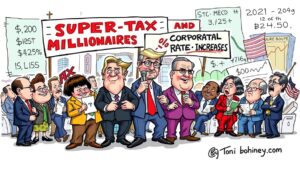

Mayor-Elect Commits to Increase Taxes on High Earners and Corporations to Fund Affordability Programs and Housing Investment

Mamdani’s Tax Agenda and Revenue Generation Strategy

A central element of Zohran Mamdani’s campaign platform involves increasing city tax rates on millionaires and raising corporate gross receipts taxes. These measures would generate an estimated 2.5 to 3 billion dollars annually according to Mamdani’s tax policy advisors. The revenue would fund his 100 billion dollar housing production initiative, direct investment in public schools, and expanded affordable transit services. Yet tax economists and business groups have raised questions about whether such increased rates would remain competitive compared to other major American cities and whether wealthy residents and corporations might relocate rather than accept higher liability.

The Proposed Millionaire Surtax Structure

Mamdani’s plan would impose an additional 3 percent tax on all income exceeding 1 million dollars, raising the effective marginal city tax rate for high earners from 3.876 percent to 6.876 percent. This would rank among the highest city tax rates in the nation. Only San Francisco approaches this level, with a gross receipts tax on businesses reaching 8.625 percent in select sectors. The millionaire surtax would affect approximately 85,000 households, concentrating the tax burden on roughly 1.6 percent of the city’s population but generating substantial revenue from that narrow base. Mamdani argued that extreme wealth concentration justified aggressive taxation of ultra-high earners.

Corporate Gross Receipts Tax and Business Climate Concerns

Mamdani proposed raising the corporate gross receipts tax to 1.5 percent from its current level, affecting all businesses with annual receipts exceeding 1 million dollars. This creates exposure across a wide range of service businesses, retail establishments, and professional firms. The New York City Partnership, a business advocacy group, estimated the combined millionaire surtax and corporate rate increase would raise marginal effective tax rates facing high-income individuals and corporations to levels that exceed comparator cities. They expressed concern that the higher rates could induce migration of both individuals and corporate headquarters to lower-tax jurisdictions.

Comparative Tax Analysis and Interstate Migration Implications

Tax policy experts from institutions including the Manhattan Institute examined comparative tax burdens. Their analysis found that a high-earner resident in Manhattan would face total combined federal, state, and local tax rates approaching 53 percent on marginal income above 1 million dollars if Mamdani’s proposals were implemented. By comparison, Dallas residents face a top marginal rate of approximately 37 percent, and Los Angeles residents face approximately 51 percent. Such differentials can influence individual relocation decisions, particularly for those with portable skills and incomes. Some studies of past tax increases in major cities suggest that a 2 to 3 percent increase in effective rates produces modest outmigration, but the relationship remains disputed among economists.

Mamdani’s Equity Arguments and Redistribution Philosophy

Mamdani and his economic advisors explicitly reject the premise that tax competitiveness should constrain progressive taxation. They argue that the historic concentration of wealth in fewer hands requires deliberate redistributive action. If some high earners migrate to lower-tax jurisdictions, Mamdani advisors note, the departing income is replaced through tax revenue from remaining residents and through reduced demand for high-end services and goods that typically employ lower-wage workers. The net effect on total city employment and income could actually be positive if resources are directed toward public services and affordable housing that support working and middle-class residents. This represents a philosophical stance that explicitly prioritizes equity and social goals over the competitive tax positioning that typically guides municipal policy.

Revenue Generation Feasibility and Economic Growth Effects

Estimates of the revenue actually generated by Mamdani’s tax proposals range widely depending on assumptions about behavioral responses. The Mamdani administration’s projections assume minimal migration of high-income residents and continued business growth. Conservative estimates from business groups suggest actual revenue could be 10 to 20 percent lower than the 2.5 to 3 billion dollar projection if migration and economic activity shift outward. A critical question is whether increased tax revenue from higher earners and corporations might actually stimulate economic activity through public investment in housing and infrastructure, offsetting any negative effects from higher rates. Mamdani’s theory of change assumes that expanded housing supply, better transit, and improved public schools funded through his tax increases would actually make New York more competitive and attract residents and businesses despite higher tax burdens.

State Approval and Implementation Challenges

New York City cannot unilaterally implement tax increases without state legislative approval. Millionaire surtaxes on earned income require modification of state tax law to create a city-specific income tax above the state level. The state budget process presents the most logical vehicle for such legislation, but securing approval requires support from upstate legislators who represent lower-income constituencies. Some observers note that state legislators from lower-income districts opposed similar proposals under previous mayors, viewing them as favoring wealthy urban elites. Nevertheless, progressive political momentum in the 2026 state budget may create an opening for Mamdani to advance his tax agenda. The mayor will need to build legislative coalitions and demonstrate that his tax increases fund clearly identifiable public benefits that resonate with voters outside Manhattan.